How To Break Into Real Estate Private Equity With Mechanical Engineering Background

How to Become Into Private Equity?

So you would similar to break into a individual disinterestedness Individual disinterestedness (PE) refers to a financing approach where companies acquire funds from firms or accredited investors instead of stock markets read more career? And you want to know how to get into private disinterestedness without whatsoever hassle!

In that location is both practiced news and bad news.

Commencement, hither'south the adept news – if you lot read this article through and through, you lot volition accept sufficient ideas near how to beginning a career in private disinterestedness.

2d, the bad news is – that if you're not from a relevant background (we will mention what is relevant), yous will never interruption into individual disinterestedness.

So, without any ado, let's go started.

Source: Michaelpage.com

In this article, we volition talk virtually –

- Understanding Private Disinterestedness Professionals Background

- How to get into Individual Equity – Of import Points to Consider

- Educational Qualifications required for Private Disinterestedness

- How to Become Into Private Equity – Skills required.

- Compensation & Work-life balance in Private Equity

- How to get into Private Equity – Strategies to get you started

- In the terminal assay

Understanding Individual Equity Professionals Background

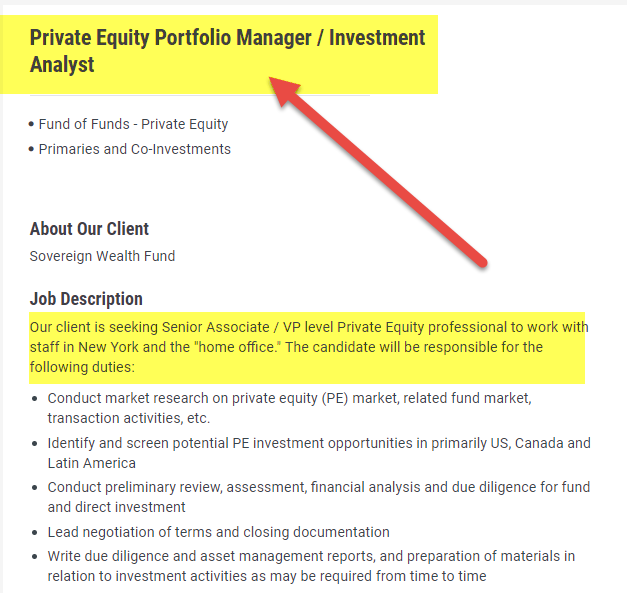

How to get into individual equity – Here'south the thing. First, please wait at the Private Disinterestedness Chore Profile and the desired background of the candidates.

To break into private equity, you demand to have a background mentioned beneath –

- If y'all are an undergraduate in finance or relevant fields like economics, accounting, etc., you are from a top-notch found.

- If y'all are an investment cyberbanking annotator, elite boutique investment bank The top boutique investment banks are - Perella Weinberg Partners (Global M&A Advisory – Boutique), Lazard (Global M&A Informational), Rothschild (Global M&A Advisory – Boutique), Evercore Partners (Global Grand&A Advisory – Boutique), Greenhill & Co. (Global M&A Advisory – Boutique, Blackstone (Global M&A Advisory). read more than , or in-between bank;

- If y'all take already been working in a PE firm and would like to become to a large firm;

- If y'all are an investment banking analyst Investment Banking Analyst works with investment banking team and expertise in the surface area of Bookkeeping, Financial Modeling, Project financing, Project Valuation, and Fiscal statement Analysis. These analyst has deep knowledge in Excel and they are skillful at VBA to analyze the market information and financial modeling. The analytic piece of work consists of building a financial model for different projects like Infrastructure projects (i.e. Power projects, real manor, etc.). read more at a pocket-sized bazaar bank;

- And finally, if y'all are someone who has a background in ane of these four sectors – investment banking Investment banking is a specialized banking stream that facilitates the business entities, regime and other organizations in generating upper-case letter through debts and equity, reorganization, mergers and acquisition, etc. read more , corporate development, corporate restructuring, and strategy consulting.

If you are not from the above background and would like to get into private equity, information technology would be also tough for you lot. For instance, it would not exist like shooting fish in a barrel to get to countries like the United states and U.k.. But in countries like Canada, India, Brazil, Russia, or Portugal, you may endeavor to get in because people from different backgrounds are hired in these countries for small individual equity firms.

How to get into Individual Equity – Important Points to Consider

At present, here are a few key points to consider if you lot want to break into the individual equity market place –

- Historic period is simply a number. But if you lot want to get into private equity, your age should exist less than xxx years for an entry position. However, if you're going to go into a senior position and have relevant experience, your age can exist more than than xxx.

- Virtually people have a few years of experience when joining a private equity house, subject to i exception. If you lot are an undergraduate and hired by big private equity firms similar Blackstone or KKR, you don't need whatsoever feel to suspension in.

- If yous want to have the edge over your peer grouping, you lot should do multiple internships at peak top-notch individual disinterestedness firms Private disinterestedness firms are investment managers who invest in many corporations' private equities using various strategies such as leveraged buyouts, growth capital, and venture capital. The elevation individual disinterestedness firms include Apollo Global Direction LLC, Blackstone Grouping LP, Carlyle Group, and KKR & Visitor LP. read more than , to begin with. That's why networking is very useful if you know more people in the individual disinterestedness industry, your barriers to entry Barriers to entry are the economic hurdles that a new aspirant must face in order to enter a market. For example, new entrants must pay stock-still costs regardless of production or sales that would not accept been incurred if the participant had non been a new entrant. read more .

- Finally, if you choose a fund to work for where the recruitment is not very structured, you lot can outset your career in private equity.

You don't have any relevant background mentioned above, but you still would like to intermission into private equity (you have keen passion and enthusiasm for private equity). What would you practice? You have the following options –

- If you lot have prior banking feel and are way too senior, yous can bring together a private disinterestedness firm as an Operating Partner or Consultant.

- If you take washed an MBA and have relevant experience in investment banking, consider the get out strategy and join a PE firm as a mail-MBA associate.

- You lot can also consider real estate roles like commercial real manor brokerage to interruption into real estate private equity.

Now, let's expect at the educational groundwork you lot must have to break into individual disinterestedness.

You are gratis to utilize this paradigm on your website, templates etc, Please provide u.s. with an attribution link Article Link to exist Hyperlinked

For eg:

Source: How to Become Into Private Equity? – A Complete Beginner's Guide (wallstreetmojo.com)

Educational Qualifications required for Individual Disinterestedness

How to get into private disinterestedness – If you want to join a individual equity business firm, y'all need to exist a elevation-notch educatee and pursue your studies at a top-notch university.

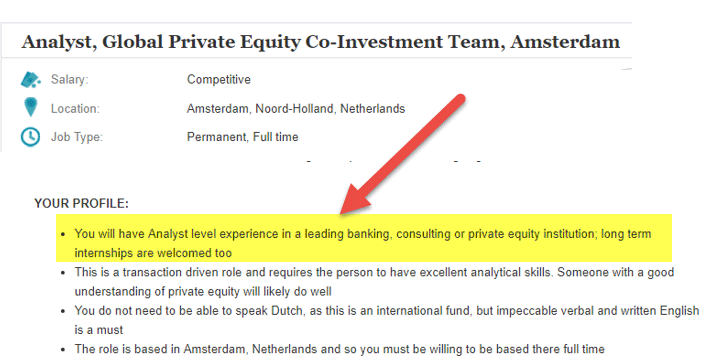

source: efinancialcareers.com

Here are the nuts you need to know about educational qualifications required for getting into private disinterestedness –

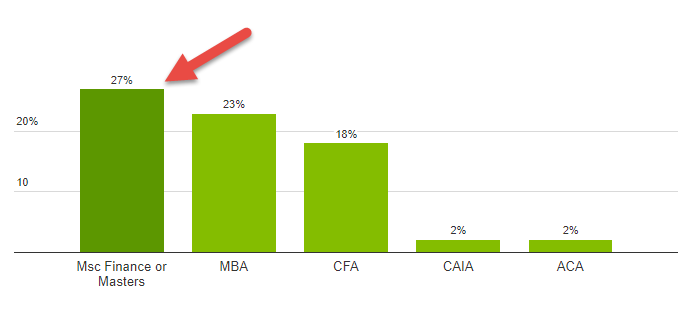

- Masters in Finance – The first and about important degree you should go for is a chief'southward in finance. EFinancialCareers.com has gone through 1.six million resumes, and they found that almost 27% of individual equity professionals hold a main'south caste. So, if you're pursuing your available's degree in finance, consider doing a primary'due south degree in the same discipline.

- MBA from Top Notch Institute – Know that individual equity firms are very selective about who they cull to choice. There are diverse requirements, and you lot volition exist left behind if yous don't adhere to them. First, you demand to do an MBA (if you are not pursuing a principal's in finance). Whatsoever MBA wouldn't cut. Information technology would assistance if you pursued an MBA from a top-notch found. In the USA & Europe, there are just a handful of universities from which big individual disinterestedness firms pick their people – Harvard, Wharton, INSEAD, Stanford, Oxford, Cambridge, HEC & ESSEC. So, consider doing an MBA from the institutes mentioned above if yous still have the scope. EFinancialCareers.com has gone through ane.6 one thousand thousand resumes, and they found that virtually 23% of individual equity professionals hold an MBA. Otherwise, to exist selected by a top-notch private equity firm, you need to have outstanding skills and experience in private disinterestedness.

- Chartered Financial Analyst or CFA – Some other qualification y'all can aim for is CFA. Now, CFA is non for the faint-hearted. You need to accept four years of full-time relevant experience and clear three reasonably tough levels. If you consider pursuing CFA, you lot would have some additional benefits. You lot tin go for many investment career options other than private equity – investment cyberbanking hedge funds A hedge fund is an aggressively invested portfolio fabricated through pooling of various investors and institutional investor's fund. It supports various avails providing high returns in commutation for higher hazard through multiple risk management and hedging techniques. read more than , equity research, etc. According to eFinancialCareers.com, they have plant that 18% of individual equity professionals have a CFA caste.

- Other Certifications like CAIA and ACA – You can also go for a few other additional qualifications like CAIA (Chartered Alternative Investment Analyst) In that location are two levels to the CFA® CAIA test. Professional person Standards and Ideals, as well as an introduction to culling investments, are covered in Level I, while alternative investments and other integrated topics are covered in Level II. read more and ACA (Acquaintance Chartered Accountant) The Institute of Chartered Accountants in England and Wales (ICAEW) offers an ACA (Associate Chartered Accountant) course. There are three levels to the ACA exam, each comprising 15 modules and exams. read more . However, eFinancialCareers.com has mentioned that just 2% of all private equity professionals (amid their 1.6 million resumes) hold CAIA or ACA degrees.

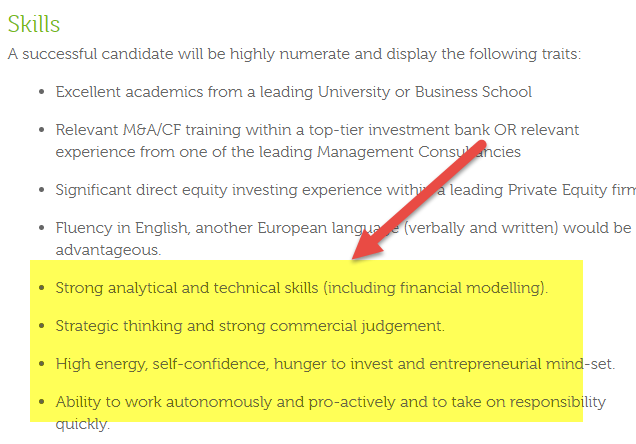

How to Get Into Individual Disinterestedness – Skills required.

Commonly, many skills are required to get into a private equity career. But there are three skills yous must develop if you desire to get in and stay for a long time. And then permit'southward accept a await at these iii skills in detail.

source: walkerhamill.com

Let's have a look at these three skills in detail.

- Technical Skills –This is a skill you must develop if you want to go into private equity – Financial assay, Valuations, Financial Modeling, Deal Structuring, Term Sail A term sail is an understanding facilitating a fundraising procedure whereby two parties mutually agree to bide past the mentioned clauses concerning the investment. read more , Due Diligence Due diligence is a thorough examination of information and strict adherence to the applicable rules and regulations. It ensures asset protection besides as the abstention of malpractices and conflicts. read more , LBO Modeling, and more. If y'all don't know these areas, consider doing an online form or training and make sure that the training helps y'all learn the skill step-past-step. If y'all tin do a video course like the Investment Banking Training Bundle or Private Disinterestedness Preparation, that would be the best option as y'all will be able to become through the grooming again and again to master the skill.

- The networking skills – This skill is the holy grail of a individual disinterestedness career. You're not from a top-notch Constitute, and you don't even accept a great career graph. All the same, suppose you take a decent background and fantabulous networking skills. In that case, you will work shoulder to shoulder with other private equity professionals who have excellent backgrounds or from Oxford, Wharton, Harvard, or Stanford. And then, how would you lot develop not bad networking skills? It would exist all-time if you were upright and confident almost your abilities. You demand to communicate briefly and professionally and tell what you tin can offer. The best way to become a networking ninja is to create a structure of your story and utilise information technology everywhere whenever you try to transport an electronic mail, personalize a telephonic advice or connect face to face with senior personnel of a big PE firm. The idea is to have no hesitation whatsoever. Yes, you will receive rejections most of the fourth dimension (at least initially), merely this skill will ultimately save you lot a lot of hard piece of work and time.

- Cold calling: Many people don't consider cold calling equally a skill, but information technology is a skill, and very few do principal information technology. This skill is an extension of the previous skill. As a job seeker in individual equity, common cold calling is your best bet. You can still email unlike private equity firms. If you cull to send emails to big individual equity firms, they will share your e-mail with their HRs, and in most cases, you volition receive a generic rejection email. And in other firms, the chances of getting a response from HR or any senior PE professional person are ane%. However, if you contact the person straight, the chances of success volition drastically increase. Commencement with smaller funds where the recruitment process is not structured. The purpose of cold calling is to get an interview. If you don't clear the interview, offer to work for complimentary for a few months and learn. This will non only add immense value to your resume; it will also push you one step ahead toward a glorious individual disinterestedness career.

- Make Connections with Headhunters – Do not expect Private Disinterestedness openings on a typical task portal. Private Equity Firms are small in size, and they depend largely on headhunters to manage the operations, including screening resumes, conducting initial tests and interviews, etc.

Compensation & Work-life balance in Private Equity

The primary purpose of getting into private equity is to earn a lot more and piece of work comparatively less. Just the truth of the matter is that private equity firms crave y'all to piece of work longer hours (sometimes longer than investment banking) if the need arises. So earning great compensation past putting in lesser work hours is a myth.

Individual Equity Analyst A private equity analyst is an annotator who looks for undervalued companies for a private equity investor to buy, take them individual and earn profits. The companies are primarily unlisted, and the gamble is higher. read more would typically work 12-14 hours a day, and depending on the workload, you may work sixteen+ hours in a few infrequent cases. Unremarkably, if you are senior personnel in a private equity firm, you lot would be able to get benefits during working hours. Merely know that there would be a healthy work-life balance, and occasionally, you may demand to cram all night.

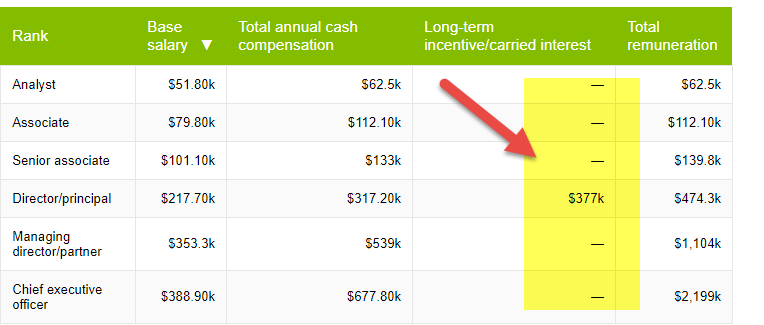

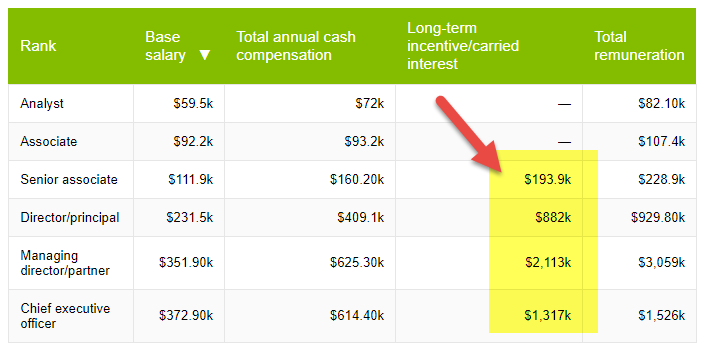

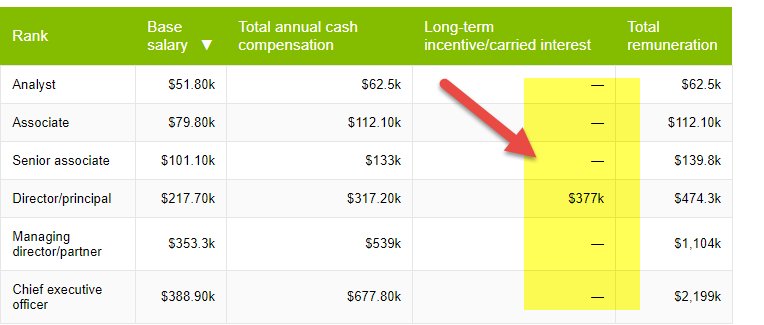

The bounty is the main attraction of PE jobs. People tend to become into PE mainly because of the pay. And so let's look at the compensation of private equity professionals at diverse levels.

Private equity professionals usually get paid in three forms of bounty – basic bacon, bonuses, and carried interest. Carried interest will seem to thing once you attain a higher rung. According to Preqin, the average carried interest Carried interest, often known every bit "conduct," is the portion of profit earned by a individual equity firm or fund managing director upon the fund'due south leave from an investment. This is the nearly important part of the Fund manager's total remuneration. read more than associates and senior associates in the U.s. receive is within $lx,900 to $200,000 per annum. If we add these carried interests with the cash compensation of $173,000 to $259,300 per annum, and so it'due south a huge sum of money.

However, carried interests make more than sense in the case of MDs and CEOs. MDs and CEOs of large equity firms in the The states receive $3.3 million and $iii.4 meg per annum only in carried interest. In Europe, MDs and CEOs receive around $iii million and $ane.5 1000000 in carried interest.

Now, let's have a look at the compensation at each level in PE firms (In the Us, Europe & Asia) –

Average Private Equity Pay in the United States

source: efinancialcareers.com

Boilerplate Individual Equity Pay in Europe

source: efinancialcareers.com

Average Private Disinterestedness Pay in the Asia Pacific

source: efinancialcareers.com

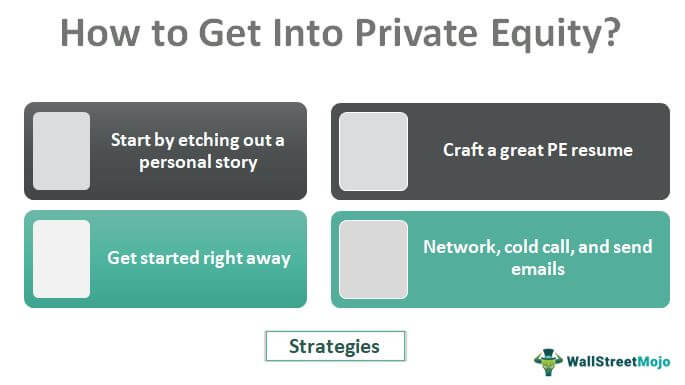

How to become into Individual Equity – Strategies to get you started

There are a few things you need to get started right away –

- First by etching out a personal story: Construction a story containing your background, why you are interested in private disinterestedness, how you lot developed your involvement in PE, where you did your internship (if whatever), and how y'all want to shape your career in private equity. This would exist your selling pitch whenever you are asked to introduce yourself or whenever you volition talk to someone over the phone for an interview.

- Craft a great PE resume: Ideally, the resume should be ane page long. You tin go for 1.5 pages max. And remove "objective," "hobbies," and "personal information." The simply talk about your professional experience deals with educational qualifications, extra-curricular activities, and contact details. And make sure that you lot use all the PE terms as action verbs.

- Network, cold telephone call, and send emails: Do three. If you want to get ahead in your PE career, these three will exercise the trick. First, find out who you demand to connect to. And then retrieve or ship an email or sit face-to-face if possible. If yous're a junior professional, you tin can consider doing internships for pinnacle-notch banks if they don't offer you interviews immediately.

- Get started right away: End reading and start interim. Massive activity is the key if you're serious nearly your PE career. Beginning with anything. Find out most someone who you tin can contact today or craft your PE resume.

How to Get Into Individual Equity – Final Analysis

A solid groundwork is a cornerstone of breaking into the individual equity market. However, if y'all have a burning desire and know-how to network, you will win half of the boxing right away. The idea is to commencement immediately.

Recommended Articles

- Private Disinterestedness in Russia Private equity firms in Russia provide a diversity of services, such as identifying growth capital letter and buyout opportunities, as well as strategizing from the perspective of a law firm. read more than

- Differences Between Angel Investment vs. Venture Capital Angel investments are fabricated by high-net-worth individuals, who oftentimes are breezy investors, whereas venture uppercase investments are made by venture capital letter firms, which are funded by companies that puddle funds from numerous institutional investors or individuals. read more

- Top 10 Best LBO Books (Leveraged Buyout)

- LP vs. GP in Private equity

How To Break Into Real Estate Private Equity With Mechanical Engineering Background,

Source: https://www.wallstreetmojo.com/how-to-get-into-private-equity/

Posted by: hobgoodplas1968.blogspot.com

0 Response to "How To Break Into Real Estate Private Equity With Mechanical Engineering Background"

Post a Comment